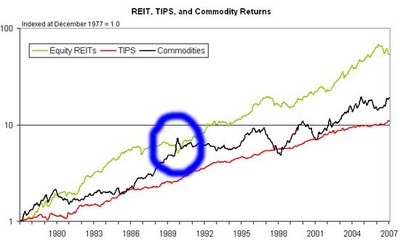

As this NAREIT chart conveniently shows, equity REITs (in green) declined in the early 1990s (circled in blue), even though the Gulf War and high oil prices were driving commodity prices (in black) higher:

Even more conveniently, this NAREIT chart, with inflation added in via the CPI, shows that REITs were actually highly correlated to the S&P 500 (i.e. stocks!), and that both performed horribly during the early 1990s:

These NAREIT charts help illustrate that the market value of all types of commercial properties actually collapsed after about 1989, even though the CPI and commodities rose. So why did this happen? The lesson from the early 1990s is that in the short run, private real estate equity and public real estate equities are not effective hedges against inflation if there is a large overhang of supply. Indeed, this video on retail big box vacancies in Orange, CT shows that one result of oversupply is high vacancy rates:

For those of you who prefer more excruciating detail, this study by Wurtzebach, Mueller and Machi (circa 1991) takes an academic approach to explain what may already be intuitive to those of you that own and operate commercial real estate: real estate is an effective hedge against inflation only if the markets are in balance. If the markets get out of balance (defined as vacancy rates above 10%), high vacancy rates make it impossible to raise rents to combat inflation:

According to Wurtzebach, et al.,  imbalances are especially pronounced after periods of capital markets excess, such as the one we just experienced. No property sector is totally immune to the current imbalance, but retail real estate in particular faces a lot of pressure given bankruptcies at GM, Chrysler, Circuit City, Mervyns, Steve & Barry’s, Linen’s ‘N Things, etc.

imbalances are especially pronounced after periods of capital markets excess, such as the one we just experienced. No property sector is totally immune to the current imbalance, but retail real estate in particular faces a lot of pressure given bankruptcies at GM, Chrysler, Circuit City, Mervyns, Steve & Barry’s, Linen’s ‘N Things, etc.

In the auto industry alone, 881 car dealerships were closed in 2008, and GM and Chrysler have announced closings of over 2,000 more in 2009. Skyrocketing vacancy rates mean that the vast majority of these sites will languish and sit empty for several years, nevermind generate any income or appreciate in value.

REITs and commercial real estate can be an effective inflation hedge if you have a longer-term investment horizon, or if you invest specifically in REITs that own quality assets in protected markets that provide pricing power (Federal Realty Trust (FRT) being a good example). But not all investors have the luxury of the buy-and-hold approach, and if you’re hoping that inflation will be the panacea for a poorly-timed asset purchase in a weak market (e.g., Phoenix, Las Vegas, Tampa), it’s definitely time to implement Plan B.

retail REITs

reit investments

reit stocks

commercial real estate

reits and inflation

ShareThis

ShareThis

{ 2 trackbacks }

{ 0 comments… add one now }