While John Mauldin may read “hundreds of articles, reports, books and newsletters” in order to bring you the one essay each week that will “stimulate your thinking”, he will also roll for commissions, and that’s pretty much all you need to know about his weekly email. More on that later, but first, what about his most recent electronic dirge, in which his illustrious guest scribe heaped upon us innocents the same lost decade of deflation and despair that befell Japan in the wake of its banking crisis?

Presumably, those who choose to heed the call of Mauldin’s high-end affiliate marketing scheme shall be saved from this particular despair, but there’s really no need to bother. My colleagues and I spend an awful lot of time thinking about the risks of deflation and inflation relative to commercial real estate investments (ironically, REIT Wrecks also spent the weekend at an undisclosed location with an official from the Treasury Dept., and we happened to talk about this very same issue), and in our carefully considered, pretty much conflict-free opinions, Mauldin’s lost decade deflation scare is nothing but a bunch of self-serving, poorly researched crap.

REIT Wrecks is far from achieving Mauldin-like internet nobility, but I’m also not an Introducing Broker. I have actual dirt underneath my fingernails, and a decided lack of sycophantic staff willing to manicure them on a daily basis. However, since I must still add, multiply, divide and subtract on my own, I have decided to use this golden opportunity shooting ducks in a barrel!! to show you, my REIT crazy comrades, why the Mauldins of the world are not to be entirely trusted.

Mauldin’s guest “analyst” in last Friday’s email was a glorified stock broker named Niels Jensen. He runs a firm called Absolute Return Partners, and he is probably a really nice guy. It’s an innocuous compliment and also Wall Street code for not being all that bright. Indeed, the first time I heard that expression used in this manner was when he and I shared the same employer some years ago, and sadly it’s the best I can do given the quality of his “analysis”. To conclude otherwise would be to claim that his analysis is intentionally misleading…and I will leave that dirty bit up to you.

So what about Jensen’s claim that we face the same lost decade as Japan? Is there anything to it? On the surface, the parallels are alarming. It’s true, the Japanese did experience a banking crisis, and they learned that “recovering from a deflated credit bubble is a long and very painful affair.” Redundantly, barely one paragraph and a colorful but mostly irrelevant chart later, he goes on to write:

Another lesson learned from Japan is that once you get caught up in a deflationary spiral, it is exceedingly hard to escape from its grip. The Japanese authorities have used every trick in the book to reflate the economy over the past two decades. The results have been poor to say the least: Interest rates near zero (failed), quantitative easing (failed), public spending (failed), numerous attempts to drive down the value of the yen (failed); the list is long and makes for painful reading.

Finally, after more gee-whiz gobbledy-gook on such esoterica as the output gap and inelastic commodity demand, he concludes that “the ultimate outcome of this crisis will turn out to be deflation – not inflation. Inflation may eventually become a problem, but that is something to worry about several years from now. The Japanese have pursued an aggressive monetary and fiscal policy for almost 20 years now, and they are still nowhere.”

Wow! All those pretty charts and this is the best he can do? Clearly, REIT Wrecks suffers from a chart deficiency, and anyone who can send me some pretty new ones will get a free subscription to Mauldin’s newsletter. In the meantime, as usual, I have made my own.

Now, with respect to Japan being “nowhere”, there is actually good reason for that, and while the charts below are in fact hand crafted by yours truly, I must credit Foreign Affairs for publishing – barely two months ago – a convenient and timely article on the the “Japan Fallacy”, as they refer to it (Volume: 88, Issue: 2, March/April 2009). Evidently, Jensen was too busy churning client accounts to bother reading it, and somehow Foreign Affairs isn’t anywhere on Mauldin’s radar.

That aside, while it is true that Japan suffered a banking crisis in the early 1990s, and that in response the Japanese government pursued strategies similar to those now being employed by the U.S. Treasury and Federal Reserve, the similarities end abruptly there. Any further comparisons to Japan then and the crisis in United States now are just not accurate.

The reason is that Japan’s banking crisis was dramatically different from ours, and for reasons known only to him, Jensen spends no time evaluating those differences. Fundamentally, the crisis in the U.S. was caused by narrow dysfunction in our financial sector, and that caused an economic crisis. In Japan, the problem was pervasive dysfunction in the entire economy:

Japan’s malaise was woven into the very fabric of its political economy…weak domestic firms and industries were sheltered from competition by a host of regulations and collusion among companies. Ultimately, that system limited productivity and potential growth. The problem was compounded by built-in economic anorexia. Personal consumption lagged, not because people refused to spend, but because the same structural flaws caused real household income to keep falling as a share of real GDP. To make up for the shortfall in demand, the government used low interest rates as a steroid to pump up business investment. The result was a mountain of money-losing capital stock and bad debt.

The Japan Fallacy: Today’s U.S. Financial Crisis is Not Tokyo’s Lost Decade. Foreign Affairs, March/April 2009.

The Japanese and U.S. crises differ in numerous other ways, but one of the starkest contrasts is in the response of policymakers. Denial, dithering, and delay were the hallmarks in Tokyo. Jensen doesn’t bother to mention that it took the Bank of Japan nearly nine years to bring the overnight interest rate from its 1991 peak of eight percent down to zero. The U.S. Federal Reserve did that within 16 months of declaring a financial emergency, which it did in August 2007. It has also applied all sorts of unconventional measures to keep credit from drying up.

Furthermore, Jensen fails to mention that Tokyo lacked the political will to allow widespread bank failures. The collapse of Lehman Brothers remains the largest corporate bankruptcy ever in the United States, but nothing like it was ever allowed to happen in Japan.

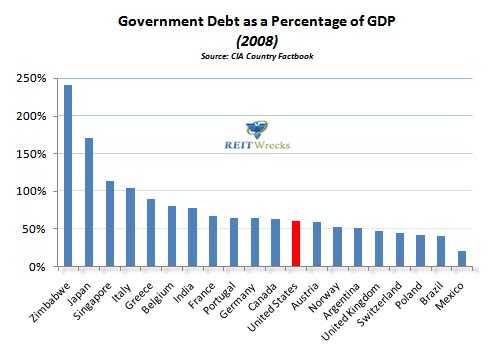

On the contrary, Tokyo used government money to help its banks keep lending to insolvent borrowers and protect their shareholders. The result was a country that became even more deeply indebted, supported by an economy that was not productive enough to pay it all off. Consequently, Japan’s public debt, already the world’s largest (second only to Zimbabwe!), will surge to 197 percent of gross domestic product in 2010, according to the OECD:

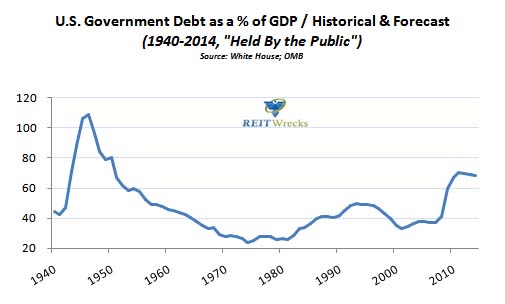

The United States, over there near its more quiet neighbor, Canada, is not even close. What about the massive $787 billion fiscal stimulus just signed into law, will that squeeze the U.S. into a cell next to Japan in debtor’s prison? It’s unlikely. The reason is that the Japanese economy is much smaller than the U.S. economy, and unlike the U.S., Japan’s population is contracting. On average, Japan’s population is also much older. As a result, Japan is much less productive than the U.S., and even though U.S. government debt is forecast to swell to about 70% of GDP through 2014, that would still be less than half that of Japan today, and far below that which was incurred by the U.S. during World War II:

Note: This graph represents the cumulative total of all government borrowings in U.S. dollars, less repayments. It does not include liabilities related to funds held in trust (like Social Security) or financial assets (like agency securities). “Debt Held by the Public” is not “external debt”, which reflects the foreign currency liabilities of both the private and public sector.

Ironically, Jensen does note that most observers condemned the Japanese approach as hopelessly inadequate, which it was, but he also implies that it was identical to what was employed by the U.S., which it wasn’t. Is this the kind of work they do over at Absolute Return Partners? If so, why would Mauldin be so devilishly fond of them??

Policy mistakes — from Japan’s mismanaged fiscal and monetary policy to the government’s failure to address the loan crisis — made a bad situation even worse. But even if policymakers had done everything right, Japan’s economy still would have stagnated until Tokyo addressed its more fundamental flaws.

A far better comparison might have been the Asian financial crisis, which proved that once financial markets are calmed and policy mistakes are reversed, economies recover. Even clumsy Russia managed to recover from its 1998 financial crisis and currency devaluation. Apparently, neither of these two examples suited Jensen’s needs.

As for the hopelessly conflicted Mauldin, what’s black and white and read all over? Unfortunately, it’s not a newspaper, as nobody reads them anymore. It’s the disclaimer in small print located at the bottom of Mauldin’s “E-letter”, conveniently overlooked by most, and which I have edited slightly for clarity:

Mauldin cooperates in the marketing of private investment offerings with Absolute Return Partners. Funds recommended by Mauldin may pay a portion of their fees to Absolute Return Partners, who will share 1/3 of those fees with Mauldin. Mauldin only recommends products with which he has been able to negotiate fee arrangements.

In other words, Mauldin will treat his loyal readers to the worst ideas from any old crap fund, so long as the fund managers can afford to pay him off for the favor. In Brooklyn, they might call this racketeering, were they not so stupefied as to how it’s all completely legal. My advice? Just go read Foreign Affairs.

Update: When I updated our software and moved to a new location on our server, the 18 original comments on this post did not automatically port to the new location. I have uploaded them all in bulk under my name below, unedited but for some line breaks in order to maintain readability.

ShareThis

ShareThis

{ 1 trackback }

{ 1 comment… read it below or add one }