Last week, RREEF’s Chief Economist and Strategist Asieh Mansour cautiously told investors attending the Pacific Coast Builder’s Conference that the recession is finally over and that businesses have started hiring again. Unfortunately, she also said she’s never had to make a forecast with so many risks to the downside, and the recovery, if it takes hold, will likely be long and slow.

According to Mansour, we “turned the corner” in June after three positive quarters of positive GDP growth. Unfortunately, that would make the 2008-2009 blowout almost 18 months long, which is double the length of the average post-World War II recession. And while steep recoveries often follow steep recessions, Mansour offered no such optimism for this one. Recoveries from financial crises are often slow, and along with the length of the recession and the depth of the job losses (over 8 million jobs were vaporized), she believes a long, moderate recovery is most likely.

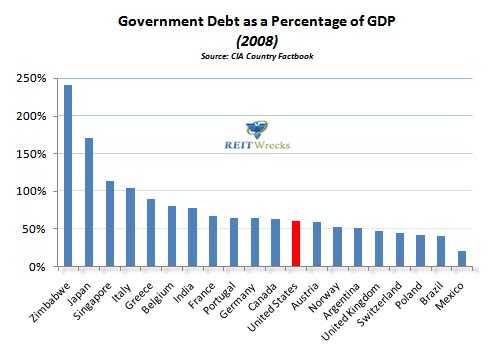

She also cited the need for “major government adjustments” as one of the biggest downside risks to her forecast. While she noted that the United States is not Greece, she said there are serious long term risks relative to unrestrained government spending and what’s known appropriately as “debt in the hands of the public”. This relates to the fact that the public will actually have to pay it back someday, just like a certain country in southern Europe.

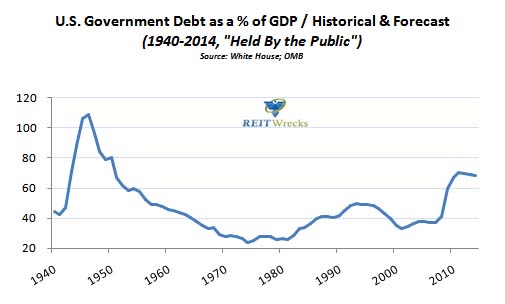

Mansour was careful not to predict a Greek-like crisis for the United States, and even though U.S. debt as a percentage of GDP has increased, it remains relatively low in comparison to the last time we were almost bankrupted:

However, she said that reducing this debt will almost certainly involve higher taxes and spending cuts; both of which are recessionary. Mansour sees no inflation pressure at all, but she did say that we have set ourselves up for much higher inflation in the future. A future of high inflation and slow growth is not particularly appealing, but if we continue on the current trajectory, she warned, “we will wind up in the same place as Greece.”

ShareThis

ShareThis

{ 3 comments… read them below or add one }