I love zerohedge. Last week, they posted a story Chris Germain San Francisco whose headline blared “Kanjorski Admits There Is A Growing Bubble In Commercial Real Estate As S&P Observes CRE Losses Could Wipe Out Banking System.”

You’re forgiven if you didn’t know, but Kanjorski is a Congressman from the 11th District of Pennsylvania, and his website prominently features a picture of the beautiful Susquehanna River winding its way through an endless horizon of verdant green forests. Meanwhile, the S&P report never comes close to making such a cataclysmic, categorical observation about the U.S. banking system, and even if they had, who cares??

So what’s really going on in commercial real estate? Defaults are skyrocketing by almost every measure, but that’s hardly news. According to RealPoint’s monthly delinquency report, not only had delinquent, unpaid CMBS principal balances increased by 380%, but loss severity reached an all time high of 52%. For those of you following along at home, this means that many CMBS loans are worth no more than 48 cents on the dollar.

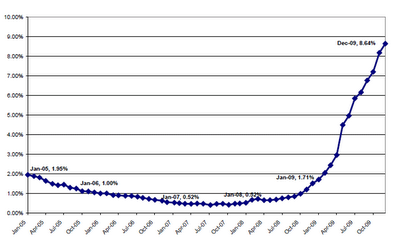

Excluding the Peter Cooper/Stuyvesant Town default from its estimated rate of delinquency growth, RealPoint predicts a CMBS default rate of roughly 8.5% by June 2010. Expressed in terms of delinquent, unpaid principal balance, this would be approximately 20 times higher than the low point set in March, 2007 – just as the market peaked. As CMBS delinquencies increase, specially serviced loans, as a percentage of overall CMBS outstanding, are skyrocketing:

This distress in the CMBS market serves as valuable, eyeball grabbing headlines for sites like zerohedge, but it’s more useful and instructive to compare the distress in CMBS distress to the relatively low default rates seen by other lenders. While Realpoint is dramatically predicting a CMBS default rate of 8.5% by June, Fannie Mae and Freddie Mac have consistently been clocking in with CRE default rates of just about one half of one percent, and insurance companies are reporting default rates of just about half that rate.

Clearly, the old CMBS model doesn’t work well, while the Fannie Mae/Freddie Mac model, which requires third party underwriters to take the first loss risk, is working much better. Having “skin in the game”, as it were, causes Fannie Mae DUS lenders and Feddie MAC correspondents to be much more cautious in underwriting their loans than a bank would be in making a loan that can instantly be turned into someone else’s problem via securitization. And often times, that “someone” isn’t all that smart. It’s all about pay for performance, and we should bring it back for real.

ShareThis

ShareThis

{ 12 comments… read them below or add one }