If you are investing in REITs right now, life is good. The US MSCI REIT index has doubled since hitting its lows in March, and in the second quarter Mid America (MAA) generated $.05/share in earnings from the sale of just one asset, a 36 year old, 96 unit apartment building in Grenada, Mississipi. Indeed, gambling on a little property in Grenada, Mississipi looks like a much safer bet right now than rolling the dice in Las Vegas, the gambling capital of the world.

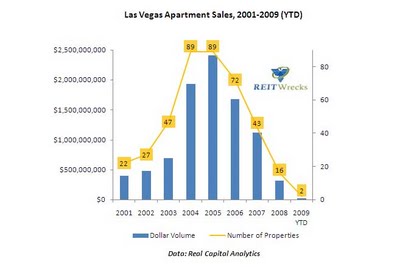

Las Vegas is so volatile that 2009 transaction volume has dropped almost to zero, and prices prices appear to have declined by at least 60% from the peak. However, with virtually no sales taking place, it’s hard to know what the market is. Amazingly, sales by dollar volume in Las Vegas have plunged by 99%, from almost $2.5 billion in 2005 to just $25 million for all of 2009:

Although only one sale had taken place through August, GlobeSt.com reported that in September, a 352-unit, 20-year-old apartment complex was sold in a short sale for $15.6 million. This price represents a 58% decrease from 2006, when the property last traded for $36.8 million. While a 58% decrease in value is frightening, it appears to be mild compared to where it could have traded.

The buyer, a San Diego socialite, was somehow convinced to pay a 5.5% cap rate on trailing-three-month NOI and a 6.1% cap on a trailing 12-month NOI. Even more incredibly, because the property was only 65% occupied by the time the sale closed, no lender would touch it, and the purchase had to be an all-cash deal. Can you say no competition?

Given the crummy fundamentals in Las Vegas, this sale is yet more evidence that the distress in commercial real estate may be cushioned by patient capital much more so than some currently expect.

Apartment values in New York City have declined at least as much as in Las Vegas. As I wrote earlier this year, the yawning gap between cap rates and GRMs means that New York City apartment values are heading in but one direction: Staten Island.

The Riverton, a massive 1232 unit behemoth of bricks that was purchased in 2006 for $340 million, is a great example. The buyers purchased the property using a first mortgage with day one debt coverage of .39x, which meant that the loan had absolutely no hope of being paid through existing cash flow.

Of course, the CMBS loan promptly became delinquent and the property is now in the hands of its special servicer, appraised at $108 million barely three years after Deutsche Bank wrote a check for its $225 million first mortgage. And the REIT goes on!

reits investing

apartment reits

reit stocks

reits

ShareThis

ShareThis