It’s summertime and the living is easy, but if you’re a distressed debt broker, this is no time to be mixing Cuba Libres at the beach. There have been 72 bank failures in the first eight months of 2009, compared with 26 in all of 2008 and just 3 in 2007. So it should be no surprise that distressed debt offerings are taking off like a teenager after a paternity test, and distressed debt traders are definitely going to have their day in the sun, whether it be by hook or by crook.

Last week, $487 million of bad commercial real estate loans were offered for sale, and $235 million of it was on behalf of just one seller. The collateral was literally all over the map: Arizona, Illinois, Wisconsin, Tennessee, Indiana, Kansas, Florida, Nevada, California, Texas, North Carolina, Missouri, Minnesota, Ohio, New Mexico and Arkansas. And this week, the Wall Street Journal chronicled the mess at Maguire, which will soon let loose another $1 billion in bad debt on the market, with collateral concentrated in Southern California.

What’s happening is no mystery. These loans are succumbing to conditions that can’t be contemplated if your stock in trade is acquiring property with OPM using interest-only debt at 90% LTV, and this is just the tip of the iceberg. While many 2005 and 2006 borrowers are still alive, the hold your breath and hope strategy they have adopted will come to an end in 2010 and 2011. And just like the mid-market loan barons at CIT, these commercial real estate contessas are pressing for an assist from Uncle Sam. However, aside from TALF and PPIP, and just like the situation at CIT, additional government assistance is unlikely to materialize.

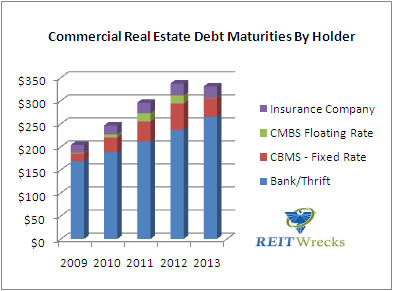

The reason is that the magnitude of the problem is being overstated. One could produce a graph showing all commercial loan maturities through 2013, and if one were to do that, it would show that there are $1.4 trillion in commercial loan maturities through 2013, and it would also show that the majority of those loans, over $1 trillion worth, are held by banks and thrifts. With bank failures increasing at an exponential rate, these the figures are the ones that the Real Estate Roundtable would use to bully congress into smothering the grenade with tax dollars:

However, the data on commercial real estate loans held by banks and thrifts comes from the FDIC, and the FDIC does not publicly release data that is granular enough to analyze the collateral backing these loans. It’s true that all of these loans are secured by commercial real estate, but many of them are actually business loans in which real estate happens to be just one small component of a much larger collateral package. Accordingly, the data does not distinguish a $5 million loan for an office building in Topeka from a company in Topeka that obtained a $5 million line of credit secured by an office building, accounts receivable and inventory.

Notably, this chart also shows that commercial real estate loan maturities climb relentlessly through 2010 and 2011, ascending to a peak in 2012, but it’s also notable that billions of dollars have been raised in anticipation of this eventuality.

As of the end of June, REITs had raised almost $15 billion in 45 public offerings, and even the beleaguered Mortgage REITs managed to scratch together $4 billion. HCP, a Healthcare REIT, closed yesterday on a $441 million stock offering, and Starwood Capital, Barry Sternlich’s new Mortgage REIT, just announced that it was increasing the size of its IPO to $800 million, which would make it the largest IPO of the entire year.

Raising money in the private market has been less productive, perhaps another $5 billion has been coaxed from the coffers of private equity investors. However, the market is nevertheless working as it should: bad debt is being recycled into equity, and amazingly enough, prices have not dropped as much as one would expect. Should the government get even further involved, using our ever-more scarce tax dollars, when private capital already seems to be doing the job?

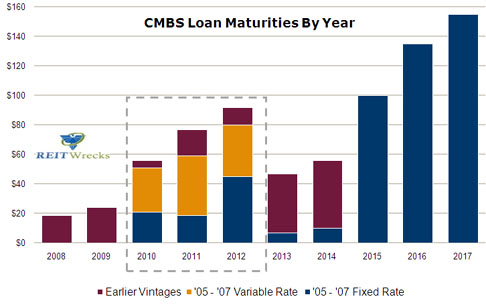

If the real estate exposure is overstated in the bank and thrift world, where will all this new money find a home? One place where the turkeys are definitely coming home to roost is in the CMBS market, where 2005 and 2006 vintage loans with five year maturities will have very little hope of being refinanced without additional borrower equity. Opportunities for new investments in pear-shaped CMBS deals will be especially abundant in 2010 through 2012:

So, if you’re looking for deals in commercial real estate, you’ll need to look even harder than everybody else. Barry Sternlicht is no dummy, and he’s definitely not alone. The truth is out there, and it congregates here!

reit investments

mortgage reits

reit stocks

reits

ShareThis

ShareThis

{ 1 comment… read it below or add one }