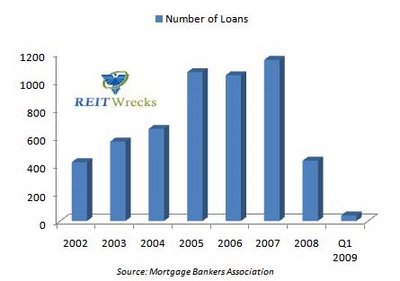

Earlier this week, I wrote that commercial real estate transaction volume had declined to practically zero, so it’s no surprise that loan originations would show a concurrent decline, but that decline was precipitous: Q1 loan originations declined to the lowest quarterly level in the 7-year period covered by the survey.

The report is unclear as to which tail is wagging this dog, however. Is the decline in loan volume the result of “suicide-tight” underwriting, or simply a lack of buyers transacting on new deals? Anecdotally, there is a lot of equity sitting patiently on the sidelines at the moment, so it’s likely the latter. In addition to the 80% decline in bank lending, insurance company loan activity declined by 66% and GSE lending dropped by 26%. It was so bad, I decided to paint a picture. the things I do for you

There were some intriguing data in the survey though (read the full report here). One interesting finding is that while all loan activity decreased, industrial loan activity this quarter decreased the least vs. the year ago period, even less than multi-family. In fact, industrial loan activity from Q4 to Q1 actually increased by 67%. With loan capital still flowing into that sector, well capitalized industrial REITs are still relatively healthy.

Indeed, industrial REIT yields are among the lowest in the sector. This should enable industrial REITs to recover more quickly. Unfortunately, that is small comfort to those who lost their shirts betting on the likes of Pro-Logis (PLD). It’s also a sign of hope around increased economic activity, and probably of inflation as well…

Not surprising is that Fannie Mae and Freddie Mac continue to be practically the only game town for apartment lending, which declined by 61% in the quarter from one year ago. Hotel loans were down a whopping 88%, followed by healthcare (down 80%), retail (down 76%) and office lending (down 66%). Aside from the good news for industrial REITs, the only other obvious silver lining is that the rate of decrease in activity has slowed. So things aren’t getting much worse, but it’s still awfully hard to see anything even remotely shaped like a “V” on the horizon.

commercial real estate

commercial real estate

commercial real estate loans

reit investments

reit stocks

reits

reit news

ShareThis

ShareThis

{ 2 trackbacks }

{ 1 comment… read it below or add one }