This can mean only one thing, and in the words David Hamamoto, CEO of Northstar Realty Finance (NRF), it is that there is a growing backlog of motivated sellers who “will begin to transact later this year and who will establish market pricing as deals are completed.” That people will need to sell is not in dispute, but exactly what “market pricing” will be is the $64,000 question.

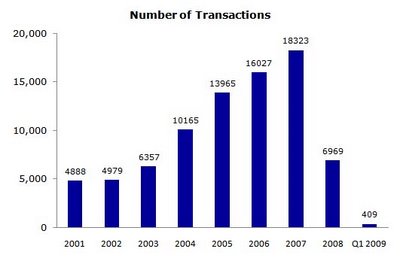

Globally, commercial real estate sales plummeted more than 70 percent in the first quarter from the end of 2008, according to Real Capital Analytics. In the United States, first quarter sales were not only anemic, they may also be a form of karmic justice to CRE brokers who are now fond of saying that distressed buyers simply “overleveraged”. Really?

Even apartments, which still enjoy the availability of buyer financing from Fannie Mae and Freddie Mac, saw transaction volume fall 62 percent in 2008, and another 86 percent in the first quarter of 2009 alone. With an average of only 50 apartment sales taking place each month across the entire country, it’s simply no wonder that pricing is unclear.

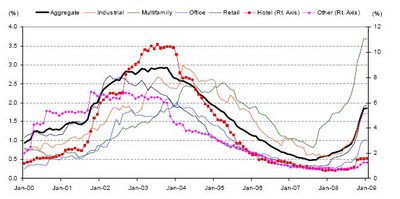

What is clear, however, is that prices are dropping. And as prices drop, “overleveraged” buyers, or those who were basically convinced to overpay for their assets, are unable to refinance their loans. CMBS loans placed in “special servicing”, which indicates that the borrower is in some form of distress, were dramatically up and to the right at the end of 2008:

(January 2000 through January 2008)

That trend accelerated in the first quarter of 2009. CMBS loans in special servicing jumped another 48 percent (as measured by outstanding loan balance), according to Fitch. “Imminent default” was cited as the reason for 73 percent of the special-servicing transfers. Since the end of 2007, the percentage of CMBS loans in special servicing has grown from 0.54 percent to almost 3 percent or outstanding loans.

Nationally, default and delinquency rates for CMBS rose to 1.76%, or $10.7 billion, in the first quarter, up 62 basis points from the previous quarter and more than triple the rate of delinquencies recorded in Q1 2008 (these figures do not include loans associated with the bankruptcy of General Growth Properties). According to REIS Inc., the CMBS default rate could reach 6% by year’s end.

The lack of transaction volume and the increasing levels of distress perfectly illustrate the current market quandary: lenders are unwilling to foreclose on properties that cover debt service, albeit barely, and sellers are unwilling to sell properties at what they believe to be artificially low prices driven by unsustainably low availability of debt capital.

This face-off will not last. Banks must clear their balance sheets at the same time that capitalization rates are rising and NOI is dropping. Rising cap rates mean that a buyer of an office building at a 6 cap in a strong market like Washington D.C. is staring at a 30% decline in value, peak to trough, assuming NOI has remained the same (which is almost certainly not the case). Buyers in tertiary markets are in even worse shape.

However, just as the excess of ready and available credit led to unsustainably high asset values in 2005-2007, so will the dearth of ready and available credit lead to unsustainably low asset values in 2010. Not surprisingly, some investors smell opportunity, and they are betting with real money. Publicly traded REITs raised $10.6 billion in equity in the first quarter, including $6.51 billion in April alone. This is a tidal wave of cash, and the Bloomberg REIT stock index rose by 30%. Nobody ever rings a bell at the bottom of a market, and $10.6 billion says why bother to listen for it now?

commercial real estate

commercial real estate

reit investments

reit stocks

reits

reit news

ShareThis

ShareThis

{ 2 trackbacks }

{ 0 comments… add one now }