Back in 2005, executives at Camden Property Trust (CPT), a REIT specializing in large apartment complexes, were worried. Why had they been unable to maintain their average occupancies at historical levels? They fanned out across the country to talk with CPT property managers, who complained of having to turn down the credit of applicants for $700 a month apartments when home lenders across the street were providing the same questionable applicants with mortgages worth $350,000.

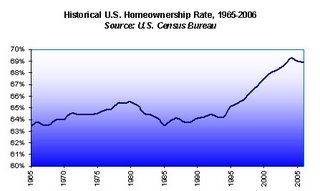

The CPT executives were suspicious about the mortgage credit checks, but they were unable to confirm their hunch. Numerous observers had been monitoring the record growth in the U.S. homeownership rate, including the Boston Globe which published a 2005 article entitled The Dark Side of Subprime Loans. The article was suspicious  about “so-called subprime loans” but until the cracks in that market began to appear last spring, there was no way to know for sure what was happening.

about “so-called subprime loans” but until the cracks in that market began to appear last spring, there was no way to know for sure what was happening.

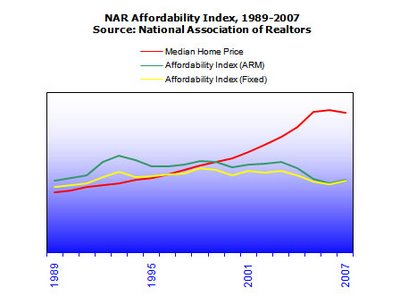

What everyone could see, however, was that the U.S. rate of homeownership had reached historically high levels. It was at about that time that both outgoing Fed Chairman Alan Greenspan and incoming Fed Chairman Ben Bernanke both played down the possibility of a so-called “housing bubble”. As it turned out, there was a bubble, encouraged not only by subprime mortages, but also by numerous government policies that encouraged homeownership.

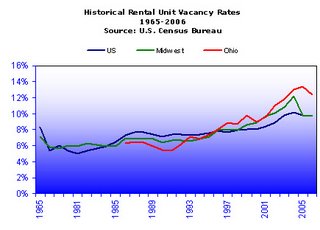

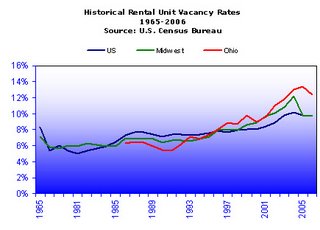

Not surprisingly, the same census data that showed increasing rates of homeownership also showed increasing levels of vacancies in the nation’s rental unit housing stock. Although still higher than average, the national vacancy rate was far outpaced by above average vacancy rates in the Midwest, where homeownership is more much more affordable and economic dislocations have put pressure on the region generally.

While policy makers across the U.S. crowed about delivering the American Dream to ever greater percentages of Americans, the problem for CPT was more immediate: how do we keep our apartments full so we can grow our earnings? CPT, like many apartment owners, had no choice but to reduce their average rents, offer incentives to renew leases, ask for smaller deposits to protect against property damages, and reduce investments in capital improvements. Cumulatively however, these solutions were not much more than a band-aid in the face of a national stampede to homeownership.

While policy makers across the U.S. crowed about delivering the American Dream to ever greater percentages of Americans, the problem for CPT was more immediate: how do we keep our apartments full so we can grow our earnings? CPT, like many apartment owners, had no choice but to reduce their average rents, offer incentives to renew leases, ask for smaller deposits to protect against property damages, and reduce investments in capital improvements. Cumulatively however, these solutions were not much more than a band-aid in the face of a national stampede to homeownership.

Subprime was not the only reason for the increased levels of homeownership. Well-meaning government sponsored loan programs allowed first time home buyers to purchase homes with little or no equity, and tax laws allowed the deduction of home mortgage interest while providing generous shelters for capital gains. At the same time that the subprime market was starting to unravel however, influential law makers were also rethinking the government’s largesse.

In a New York Times article entitled “Mortgage Trouble Clouds Homeownership Dream”, Representative Barney Frank (D) Massachusetts said that United States policies in recent years had promoted the idea of homeownership too hard and at the expense of rental housing. “I wish people could own more homes,” he said in the interview. “But I also wish I could eat and not gain weight.”

Many academicians agreed. In the same article, Joseph E. Gyourko, Professor of Real Estate and Finance at University of Pennsylvania’s Wharton School of Business asserted that "we went too far. It’s not the case that high homeownership is always good.”

These increasing homeownership trends are clearly reversing, and now may be the best time in years to own Apartment REITs. Not only are secular, long-term demographics supporting improved operating fundamentals, but the havoc in the financial markets has discounted all REIT stocks.

REIT stock prices have typically been a good harbinger of property values. When they trade at or below the value of the underlying real estate, as most are now, they have traditionally predicted weakening property values. However, these times are anything but traditional, and commercial property values now are not directly connected to the wider real estate contagion because they produce reliable monthly income.

These income streams determine how commercial property is priced, and the income for apartment buildings looks strong for several reasons. First, commercial development of new-builds in this cycle has been muted by high construction costs. This limited new supply, combined with strong growth in demand from immigration and the “echo-boomers”, should provide a floor under apartment rents. Add in the thousands of households now returning to the rental pool, and apartment fundamentals have never looked more solid.

In addition to these strong operating fundamentals, the Fed has responded to the liquidity crisis by directly intervening in the government agency securities market. I wrote about this unconventional and rarely used Fed operation in a previous article, which was undertaken in an effort to reduce long term borrowing rates. This Fed action, along with its steep reductions in the discount rate, will also help support commercial property prices.

So far, values have held up. The Mortgage Bankers Association reports that in 2007, defaults in Fannie Mae loans for apartment buildings remained flat at .08%, while 2007 defaults among apartment loans sponsored by Freddie Mac declined to .02%. In fact, despite all the bad news in residential real estate, defaults in the broader commercial property sector remain at historical lows. According to the Wall Street Journal, the delinquency rate on the almost $840 billion in outstanding commercial mortgage backed securities is less than .5%. Lenders, particularly Fannie Mae and Freddie Mac, also remain active in the apartment sector, unlike other commercial property markets where liquidity has dried up.

In this market, making a REIT investment of any kind isn't for the faint of heart, but other well run, diversified apartment REITs worth considering include Avalon Bay Properties (AVB), which has a large development pipeline in high barrier markets and low leverage, and Essex Property Trust (ESS), which also operates in high barrier markets and just announced an almost 10% increase in its dividend. Avoid AIMCO (AIV) which operates in low barrier markets like the Midwest and has relatively higher leverage, and REITs like Post Properties (PSS) which had been relying on condo conversions to drive operating results.

Caveats? A deep recession will impact rents no matter how strong the fundamentals. The “shadow” rental market of foreclosed homes will also put some pressure on apartments, but rental homes do not compete directly with apartments. Most renters are not interested in mowing lawns and shoveling snow, and apartment living excuses them from these kinds of responsibilities.

Also, REITS enjoy favorable taxation treatment at the corporate level, so most do not allow for the 15% tax treatment on dividend income. Accordingly, if you decide to do any buying, it should be done in your 401k or IRA. Consider REITs for capital gains though, and think of the dividends simply as the icing on your subprime cake. Click here for a complete Apartment REIT list, including current yields

Disclosure: None

Labels: AIV, Apartment REITs, AVB, CPT, ESS