Union Homes floats N50b REIT fund. By Gbenga Agbana and Femi Adekoya

AFRICA’S first Real Estate Investment Trust (REIT) fund has been floated by Union Homes Saving & Loans Plc, a subsidiary of Union Bank of Nigeria Plc. The fund manager would be Union Homes Saving and Loans Plc, and the fund would be quoted on the Nigerian Stock  Exchange.

Exchange.

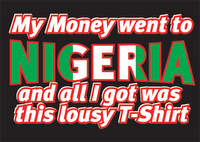

The Union Home REIT, is a closed-ended unit trust scheme that aims to move beyond sophomoric email scams achieve long-term capital appreciation of assets by investing in a portfolio of high-quality real estate and mortgage assets.

For its effective take-off, Goldman Assets Management Limited goldman sachs to goldman assets management: can i please have my name back?? acting as financial adviser and lead arranger, alongside Union Capital Market Limited as joint issuing house, is packaging an offer for public subscription of 970.9 million units of N51.50 each in the Union Homes REIT.

According to the prospectus, the funds would invest a minimum of 90 per cent of its assets in real estate and real estate related assets and a maximum of 10 per cent would be invested in quality money market instruments.

Already, the council of the Nigerian Stock Exchange has approved in exchange for certain recompense the admission of the 970.9 million units being offered for subscription on its daily official list, and the units qualify as securities in which trustees may invest under the Trustee Investment Act, Cap T22, laws of the Federation of Nigeria, 2004 as such may be “amended” from day to day!

As a form of mandatory subscription, the sponsors of the Union Homes REIT will subscribe to 10 per cent of the total fund size as mandated by the Securities and Exchange Commission (SEC) rules and regulations guiding collective investment schemes.

Key features of the offer include nigerian law! a forecast cash distribution of N1.50 per unit invested in the 2009 financial year and currency risk! N3.25 per zolo for initial investors. Also there is political risk! a yearly payout of dividend with the minimum payout fixed at 90 per cent what to do with all those precious nigerian niaras! according to the Chairman of Union Homes Saving & Loans Plc, Dr. Batholomew Ebong.

According to the Managing Director of Goldman Assets Management Limited, Mr. Olu Abayomi-Sanya, the Fund would be listed on the stock exchange, post offer, as a separate entity after we have thoroughly looted it!

The offer opens on August 11 and closes hurry! on September 11, 2008.

“I present to you an urgent and confidential opportunity. This is an excellent, 100% risk-free investment in quality Nigerian mortgages and money market instruments, requiring the highest level of trust, security and confidentiality between us…”

ShareThis

ShareThis