“It’s surprising that you’d have a New York City multifamily [default] happening so quickly,” said Manus Clancy, senior managing director at Trepp Research.

Surprising, that is, unless the mortgage payment is more than double the monthly net income. Impossible you say? Not really, this was the beginning of 2007, and almost anything was possible. “Our job is to create loans for securitization,” said an official from Wachovia Corp. a few years earlier. “We’re trying to manufacture the product that the investor base wants.” And so they did.

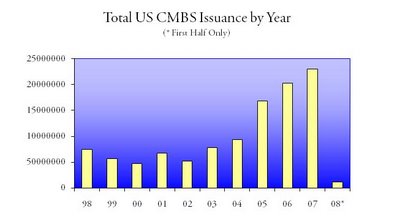

Data: Commercial Mortgage Alert

Data: Commercial Mortgage Alert

On the surface, this deal looked pretty good. The pro-forma loan to value was 66.18%, and pro-forma debt coverage was a very safe looking 1.73%. It was a “value-add” deal, and the borrowers, Stellar Management and Rockpoint Partners, planned to pump almost $30 million into improvements and then raise the rents. Pretty simple.

That led to the $225 million first mortgage, topped off with a $25 million mezzanine loan from Deutsche Bank. The first mortgage also became one of the top 15 loans by value (about 3.4% of the initial mortgage pool balance) in a nearly $6 billion CMBS deal issued in March of 2007.

Consequently, one would think that this loan would have received a lot of attention from the underwriters, bond traders and CMBS portfolio managers looking at the securitization. Presumably, these sophisticates could evaluate the loan economics more closely, particulary the rather precarious day-one debt coverage ratio of .39x, which meant that the loan had absolutely no hope of being paid through existing cash flow (‘let’s see now, the guy’s income is less than half the amount of his monthly nut….’)

But this was 2007 and the property, known as Riverton Apartments, is no ordinary piece of real estate. It is a massive 12 building, 1,232 unit complex sitting on 7.6 acres of prime East River (Manhattan) waterfront property. I wouldn’t know, but I guess that this beach-front location and the “air rights” were what justified the $250 million in debt, even though the property was purchased just 12 months earlier for about half that amount ($135 million) just sayin’. The new loan allowed the borrowers to walk away with over $40 million in cash thanks, the keys are in the mail!

At closing, over 90% of the units (1,143 to be exact) were regulated, rent-controlled apartments. The premise of the loan was that these units would be converted to fair market, such that by 2011, more than half of them would be deregulated and rented at full market.

At closing, over 90% of the units (1,143 to be exact) were regulated, rent-controlled apartments. The premise of the loan was that these units would be converted to fair market, such that by 2011, more than half of them would be deregulated and rented at full market.

Unfortunately, this is also New York City, and the only thing more coveted than a long weekend in the Hamptons (or perhaps a phat Congressional seat) is a rent-controlled apartment. Consequently, the conversion did not go as planned, and that .39% day-one debt coverage ate up whatever was left in just eighteen months.

ShareThis

ShareThis

{ 1 trackback }

{ 0 comments… add one now }