If housing prices fall another 10%, as they seem likely to do, the study estimates that families will have a net worth anywhere from 56% to 67% less than they had in 2004. That corresponds to an average decline of $41,000 in median wealth and show, according to the authors, that homeownership is not always an effective way to generate and accumulate wealth. Go figure.

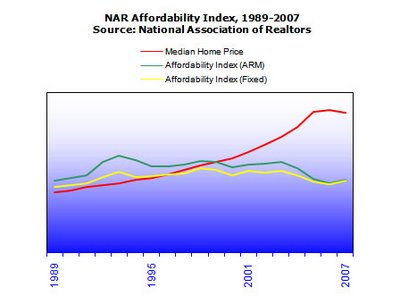

However, a study conducted in early 2005 by none other than the National Association of Realtors showed that over two-thirds of all first time home buyers at the time had put down less than 10% to purchase their homes, and a whopping 42% of those first-time buyers had put down nothing at all. It’s no wonder, since their own data show nobody could afford to buy a house in the first place:

So is the bursting of the housing bubble really as damaging to family wealth as it seems? If the NAR is to be believed, none of this money was really wealth in the first place. Rather, it was just another result of a massive, nationwide borrowing binge. But now that the bill has come due (talk about a balloon payment!) who is going to pay it all back?

For a clue, look no further than Fannie Mae and Freddie Mac, which found new owners on Tuesday (you and me). Now, through them, you and I are effectively acquiring 66,000 houses a day through foreclosure.

How about a cute little fixer upper?

Click here for an updated list of Mortgage REITs, including current yields.

ShareThis

ShareThis