According to the NAR, which just released its new home sales statistics for February, the supply of homes in the U.S. dropped 3 percent at the end of last month to just over 4 million homes. This translates into an approximately 9.6-month inventory of new homes, compared to about 10.2 months at the end of January. In addition, the NAR says the national median existing-home price for all housing types was $195,900 in February, down almost 10 percent from 12 months ago.

Some, including the NAR, are suggesting that this decline in inventories, a rise in existing home sales, and the almost 10% drop in the median house price may be signaling an end to our national housing malaise. In reality, prices still need to correct – and substantially – before we see an end to this housing implosion.

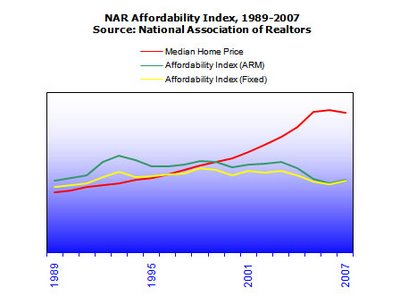

Unfortunately, median home prices remain far too high relative to incomes, and no amount of optimistic NAR press releases can obscure that fact. In this case, a picture truly is worth a thousand words, because the NAR’s own data convincingly tells the story:

Now that the credit spigot has been all but shut off, and wages are coming under pressure from an almost certain recession, housing prices – even at current levels – cannot be sustained. In fact, it looks like they have much further to drop. NAR economists are undoubtedly already working over-time to unearth a fresh silver lining for next month’s press release, and judging by their own data, they will need their most creative minds.

ShareThis

ShareThis